401k inheritance tax calculator

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. With this option all the funds from the 401k are distributed to you at once and you will pay income tax on the full amount but you will not incur.

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Ad Keep A Parents Low Prop 13 Tax Base On Inherited Property.

. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. If you make 70000 a year living in the region of California USA you will be taxed 15111. Your average tax rate is 1198 and your marginal.

Save 6000 A Year On Average. If you take distributions in a year. Reviews Trusted by Over 45000000.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Inheritances are not typically considered income for. Naming beneficiaries can keep your 401 k out of probate court.

A contingent beneficiary is eligible to inherit the 401 k if. Compare 2022s Best Gold IRAs from Top Providers. Reviews Trusted by Over 45000000.

4 You must disclaim the account within nine months of. When you enroll in a 401 k youll name beneficiaries to inherit your 401 k if you die. In normal circumstances people who inherit money or property for that matter dont usually have to pay income tax on it.

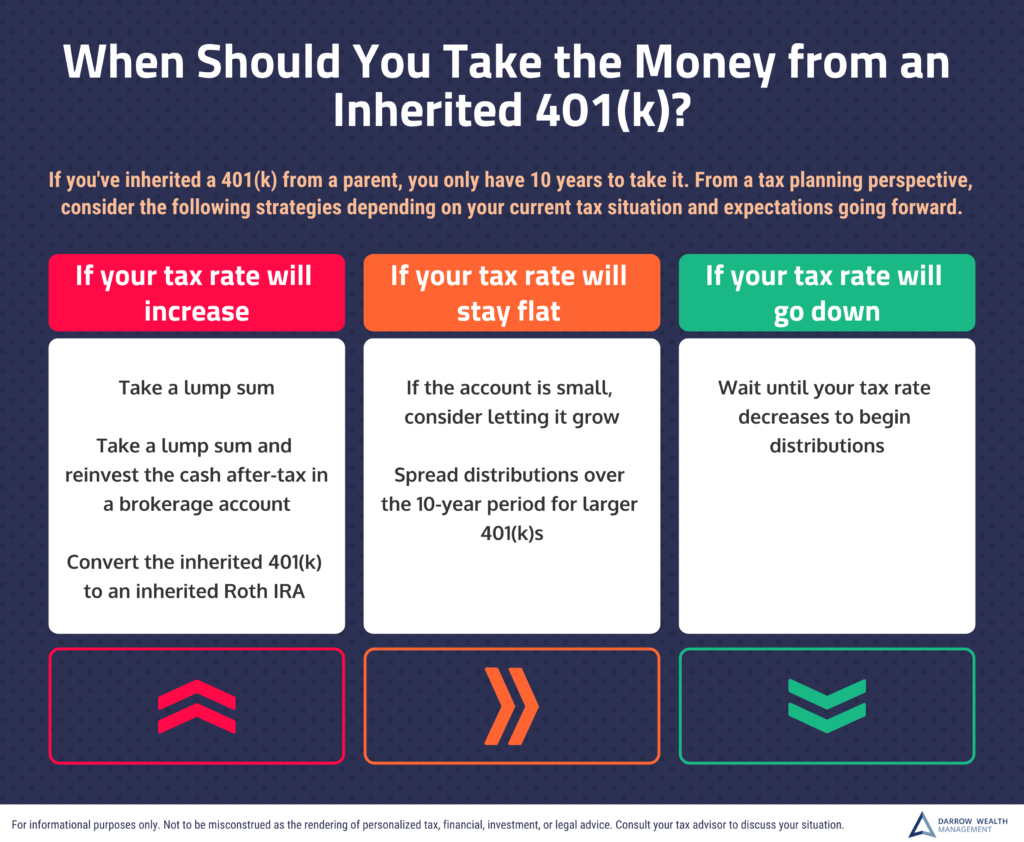

California Income Tax Calculator 2021. Take a lump-sum payment. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

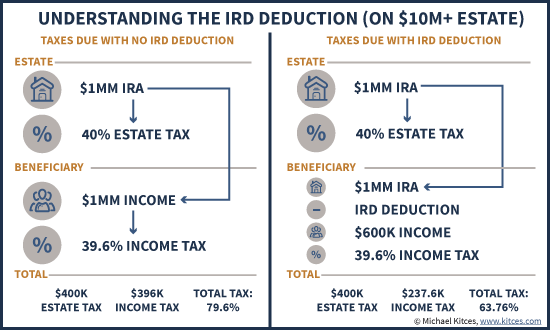

These assets will be taxed at the beneficiarystax bracket rate. A 401 k can be one of your best tools for creating a secure retirement. Save 6000 A Year On Average.

Ad Keep A Parents Low Prop 13 Tax Base On Inherited Property. Calculate the required minimum distribution from an inherited IRA. Compare 2022s Best Gold IRAs from Top Providers.

First all contributions and earnings to your 401 k are tax deferred. It provides you with two important advantages. Disclaim the account or transfer the assets to an inherited IRA and take the RMDs.

The beneficiaries who inherit the 401k assets will owe any unpaid taxes owed on the account. If youve inherited a 401 k it means the account holder listed you as a primary beneficiary or contingent beneficiary. Instead you have only two options.

In the United States most people who have funds above the exemption amount ultimately wont end up paying much estate tax according to the Urban-Brookings Tax Policy Center.

Maryland Inheritance Tax Calculator Probate

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

Inherited Iras A Sweet Deal Inherited Ira Ira Individual Retirement Account

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

401 K Inheritance Tax Rules Estate Planning

Inheritance Tax How Much Is It What To Expect Full Guide

Do I Have To Pay Taxes When I Inherit Money

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

Maryland Inheritance Tax Calculator Probate

Year End Financial To Do List How To Plan To Do List Financial

A Guide To Inheriting A 401 K Smartasset

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Tax Calculator Tax Preparation Tax Brackets Income Tax

Inherited A 401 K From A Parent Tax Planning For Distributions

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

States With No Estate Tax Or Inheritance Tax Plan Where You Die